la county tax collector auction

LOS ANGELES COUNTY TAX COLLECTOR PO. Taxes that are delinquent for five years become subject to the Tax Collectors power to sell and the property may be sold at a public auction.

Los Angeles Property Tax And The La County Tax Collector

The Tax Certificate Sale date is May 28 2022.

. 558-4988 and reference the County of Orange Tax Auction to receive the reduced price or you can contact. Melissa Lutz PCC Medina County Tax Office 1102 15th Street Hondo Texas 78861 We will honor the date on a USPS postmark. Since its inception the company has sold more than 125000 properties and grossed over a billion dollars in auction sales.

Founded in 1999 Bid4Assets hosts a variety of property sales around the US. 2018 payments with a postmark on or before January 31 2019 are considered timely. However we strongly recommend that you pay your Unsecured Property Tax Bill property tax.

BOX 54018 LOS ANGELES CA 90054-0018. If you disagree with your Unsecured Property Tax Bill because the assessee name property being assessed andor value of the property isare incorrect you may contact the Office of the Los Angeles County Assessor Assessor at helpdeskassessorlacountygov or 1213 974-3211. DO represents the drawn off date.

Tax payments please include. In order for the Excess Proceeds Claim to be considered by the Orange County Tax Collector claims must be received by the Tax Collector on or before the expiration of one year following the date of recordation of the deed to purchaser. To avoid the issuance of a Tax Certificate all payments for outstanding real estate accounts must be received and processed in the Tax Collectors Office by May 27 2022 500pm.

We are located at the Kenneth Hahn Hall of Administration 225 North Hill Street Los Angeles California 90012. Melissa Lutz Tax Assessor-Collector. - Property ID or Quick Ref ID R - Owners name.

Current year taxes are rolled or drawn off to the delinquent tax roll if they remain unpaid as of June 30 of each fiscal year July 1 to June 30. Please mail payments to. Public Auction An auction held pursuant to the California Revenue and Taxation Code Section 3691 in which the Department of Treasurer and Tax Collector auctions and sells tax-defaulted properties in its possession.

Including tax foreclosures sheriffs sales and federal forfeiture auctions. Thank you for visiting the website Site for the Los Angeles County Treasurer and Tax Collector we us or our.

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Schedule Of Upcoming Auctions Treasurer And Tax Collector

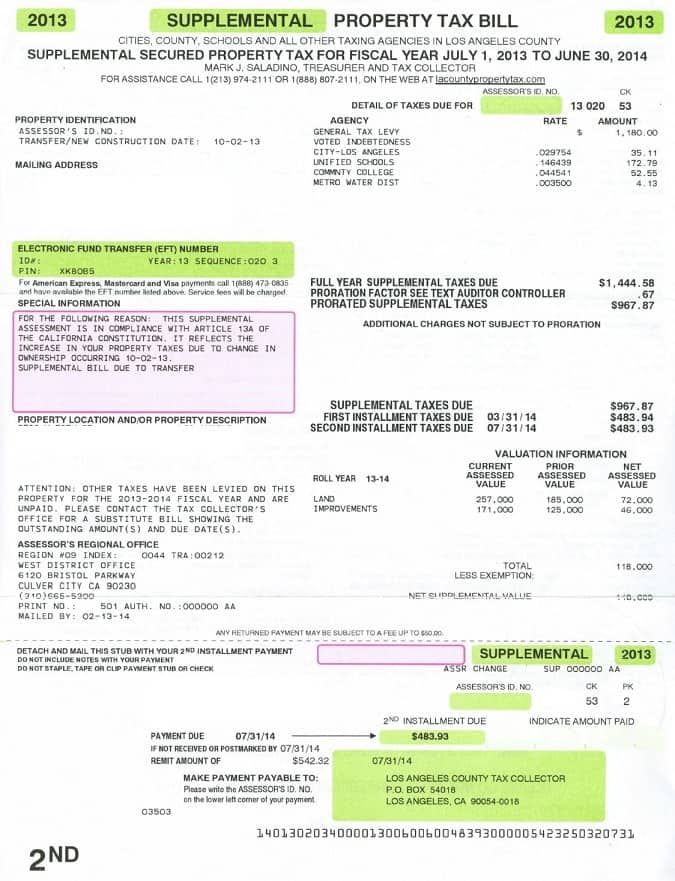

Los Angeles Supplemental Property Tax Bill James Campbell Los Angeles Real Estate Agent

Find La County Commercial Property Owners

Bid4assets To Host Online Tax Defaulted Property Auction

Notice Of Delinquency Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Buying Tax Deeds In California Know The Rules Ted Thomas

Los Angeles County Brings Tech Innovation To Property Tax Complexity

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction

Copy Of A Property Tax Bill For La County Property Tax Tax Los Angeles Real Estate

Schedule Of Upcoming Auctions Treasurer And Tax Collector

Pay Property Tax Bill Online County Of Los Angeles Papergov

Bid4assets Los Angeles County Ca Tax Defaulted Properties Auction