inherited annuity tax calculator

Tax Consequences of Inherited Annuities. Because of this only 148 of your 565 monthly payout will be subject to ordinary.

Present Value Of An Annuity How To Calculate Examples

Payments can be spread.

. Our Resources Can Help You Decide Between Taxable Vs. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Here you would sell a period of the annuity disbursement or a portion of.

Tax rate on an inherited annuity. These payments are not tax-free however. An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. The annuities would not have an RMD if your father purchased them. The earnings are taxable over the life of the payments.

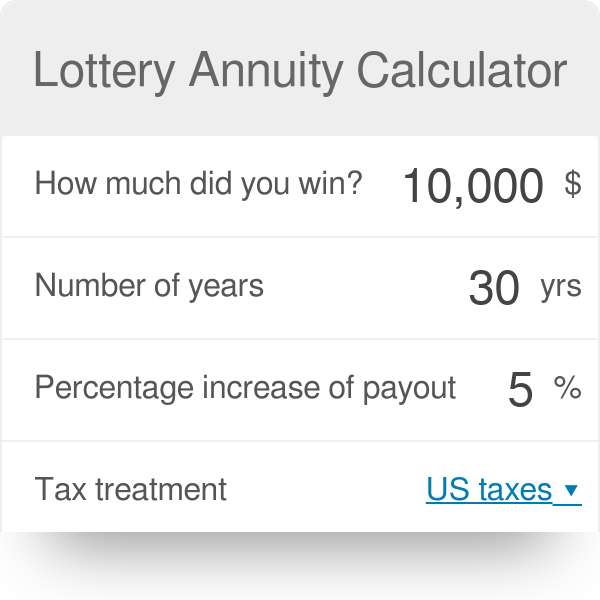

Calculate your earnings and more. How to Calculate the Taxable Portion of Annuities. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

Multiply Monthly Payout By. A tax-qualified annuity is one. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

If the annuity is an immediate annuity. In turn taxation of annuity distributions. This is a one-time lump sum payout upon the death of the annuity owner or annuity owners.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Different tax consequences exist for spouse versus non-spouse beneficiaries. If you want to simply take your.

Ad Learn More about How Annuities Work from Fidelity. Ad Learn More about How Annuities Work from Fidelity. Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income.

The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity. Learn some startling facts. Youll get a 1099-R if you received 10 or more from a retirement plan.

Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. Calculate the required minimum distribution from an inherited IRA. An annuity funded with pre-tax dollars is often a qualified annuity.

January 27 2020 1152 AM. June 3 2019 1103 AM. The first is a partial sale.

1 Best answer. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. If youre the spouse of the.

Divide Cost Basis By Accumulation Value. Annuities are often complex retirement investment products. Its basically returning to you all of the money you paid them after tax plus interest.

We Offer Innovative Products For Retirement That Help You Keep Your Plans. If an annuity is structured to include one or more beneficiaries those individuals will continue to receive payments from the contract after the. For non-IRA inherited annuities you can receive payments either a single life based on.

This means you do not have to pay taxes on the money you contribute or the interest. When an annuity payment is made 50 of each payment would be income taxable. RMD applies to a traditional IRA or a qualified retirement plan.

1 Best answer. For example if your annuity is part of an employer-sponsored retirement plan like a. Tax Rules for Inherited Annuities.

If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments. Surviving spouses can change the original contract. The estate pays estate taxes and rates vary depending on the size of the estate.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Death Benefits Payout Options. Code 4 will indicate that it was due.

You actually have two options if you decide to part with the inherited annuity. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Ad Our Income Annuity Calculator Can Help You Plan For The Future.

An IRA annuity allows you to contribute money to an account that grows tax-deferred. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received.

Life Insurance Calculator The Annuity Expert

Annuity Exclusion Ratio What It Is And How It Works

The Best Annuity Calculator 17 Retirement Planning Tools

Wealth Advisor Resources The American College Of Trust And Estate Counsel

Annuity Taxation How Various Annuities Are Taxed

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)

Calculating Present And Future Value Of Annuities

Annuity Taxation How Various Annuities Are Taxed

How To Calculate Adjusted Gross Income Agi For Tax Purposes

The Best Annuity Calculator 17 Retirement Planning Tools

2022 New Irs Required Minimum Distribution Rmd Tables

Agi Calculator Adjusted Gross Income Calculator

Annuity Beneficiaries Inheriting An Annuity After Death

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

How To Calculate Rmds Forbes Advisor

Obamacare Investment Tax Problem For High Income Earners

Compound Interest Calculator Daily Monthly Quarterly Annual

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)